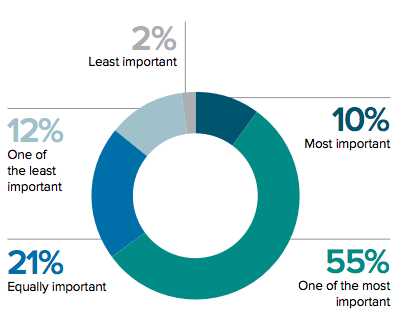

Email consistently ranks top for marketing effectiveness. In Return Path’s State of Email Engagement report, 2/3 of respondents ranked email as “most important” or “one of the most important” marketing channels:

But there’s also a catch. In Direct Marketing Association (UK)’s latest Marketer Email Tracker report, 42 percent of respondents said their biggest challenge is limited budget, closely followed by limited internal resource (40 percent).

I hear this all the time—email marketers know their programs are effective, want to do more, but struggle to make the case for investment. To help, I’ve pulled together 10 of my favorite “email value” stories.

1. Spending intentions: The DMA (UK) report shows 1/3 of respondents are committing more than 20 percent of overall marketing budget to email in the next year. This aligns with Econsultancy’s 2018 Email Industry Census report, showing 36 percent of respondents now spending above £25K on their email programs, up five percent from 2013.

2. Return on investment (ROI): Almost ¾ of Econsultancy’s respondents rated email “Excellent” or “Good” for delivering ROI (74 percent)—higher than any other major marketing channel or discipline, including SEO (70 percent), PPC (62 percent) and content marketing (61 percent).

The DMA (UK) report shows email ROI at £42.24 (up from £32.28 in 2018, an over 30 percent increase). This also reflects a GDPR-related ROI premium shown in Litmus’s 2018 State of Email Analytics report. Average ROI for EU senders is $49 compared with $40 for US senders.

3. Return on investment–by channel: The US DMA’s 2018 Response Rate report breaks out ROI by channel, and email comes up top with 145 percent. For other major online channels (paid search, online display, and social media) ROI ranges between 20 percent and 50 percent, while ROI for direct mail is 41 percent. ( Note the US DMA has a different calculation for ROI, including cost per acquisition, meaning a like-for-like comparison with the UK DMA numbers is not valid).

4. Customer lifetime value (CLV): The Litmus report showed that last year subscriber lifetime value ranked second bottom (27 percent of responders) in a basket of important metrics email marketers monitor. This year it’s the single most important metric they want to get better at measuring/monitoring (43 percent).

With good reason too! The DMA (UK) report calculates CLV at £37.32 per address (up from £28.56 in 2018 – a 30 percent increase). A 1M address list is therefore worth £37M, and investment around extending customer lifespan and/or reducing list churn should be framed against this backdrop.

5. Value per email sent: Cheetah Digital’s Quarterly Email & Mobile Benchmark report quotes revenue per email at $0.08 (Q4 2018), up from $0.06 the year before. On average, every 1M emails sent should generate $80,000 in revenue. Using Cheetah Digital’s average unique open and click rates, we can also extrapolate revenue per open at ± $0.40 and revenue per click of $3.45.

6. Opportunity cost of churn: The flip side of the CLV coin is the long-term cost of losing email subscribers. IBM Watson’s 2018 Marketing Benchmark report reports average global churn rate (bounces, unsubscribes, and complaints) at 65 percent. Bluecore’s Cost of an Unsubscribe report highlights a $17.92 loss for each unsubscribe. A 1M email list sending at a weekly frequency will lose ± $6M per year from churn.

7. Cost per acquisition (CPA): Email also has the best value for acquiring customers. The US DMA’s report shows CPA (the average cost of each new email customer) is $22.52. CPA for other major online channels (paid search, online display, and social media) ranges between $25.87 and $43.28, while direct mail is highest at $43.90.

8. Most effective marketing spend: The Econsultancy report analyses effectiveness of email spend. Since 2014, the proportion of sales attributed to email marketing averaged 21 percent. For the same period, the proportion of total marketing budget spent on email marketing averaged 15 percent. From this we can infer email spend out-performs general marketing spend by 4X.

9. Even more effective against paid spend: Recently, my colleague Gabriel Gastaud wrote a blog post on 4 Ways the Email Channel Contributes to Online Shopping. He identified email as the 3rd largest source of website traffic (14.1 percent), behind only organic search (29.8 percent) and paid search (17.7 percent). Email is also the fastest growing channel, with an 8.1 percent YoY uplift.

While traffic from email is ± 4/5 that from paid search, it costs much less. Research in an article by The Drum showed global email marketing spend in 2017 was ± $2.8 billion compared with $86.4 billion for paid search. This means email spend out-performs paid search spend by almost 25X!

10 Pull the trigger: If you’re now ready to spend more, and you’re thinking “great – but where’s the biggest bang for my buck?” start with your triggered email strategy.

Litmus’s 2018 State of Email report shows 1/3 of email programs drive at least 25 percent of their revenue from automation. This is no surprise–Epsilon’s Email Trends & Benchmarks report shows triggered open rates are almost double those of regular emails (51.7 percent vs 34.1 percent) while click rates are more than double (6.9 percent vs 3.1 percent).

In Bluecore’s Triggered Email Benchmark report, average revenue per triggered email is slightly over $2.00, with cart abandonment emails most effective at $6.77! Cheetah Digital’s Quarterly Email Benchmark report shows the trick can be repeated, with emails in a four-part welcome series generating $2.14, $0.79, $0.19, and $0.22 respectively–all much higher than Cheetah Digitals’s $0.08 benchmark!

So if you’re struggling to convince your stakeholders to spend more on email:

- Evangelize for email effectiveness–strongly!

- Know your email ROI and CLV–and frame your requests against these numbers.

- Don’t just think in terms of positive impacts, mitigate negative impacts too.

- Challenge lower-performing marketing channels for a share of their budget.

- Target planned spending where it will have the greatest impact.

Follow these tips, quote these stats, and put yourself in the driving seat when it comes to making a strong business case for taking your email program to the next level.